April 1st is known as April Fools’ day, a time to play tricks and pranks. Some historians have noted that April Fools’ Day dates to 1582. It is speculated that the start of the new year had moved to January 1st and people who were slow to get the news and/or continued celebrating the new year during the last week of March through April 1st became the butt of jokes and hoaxes (https://www.history.com/topics/holidays/april-fools-day).

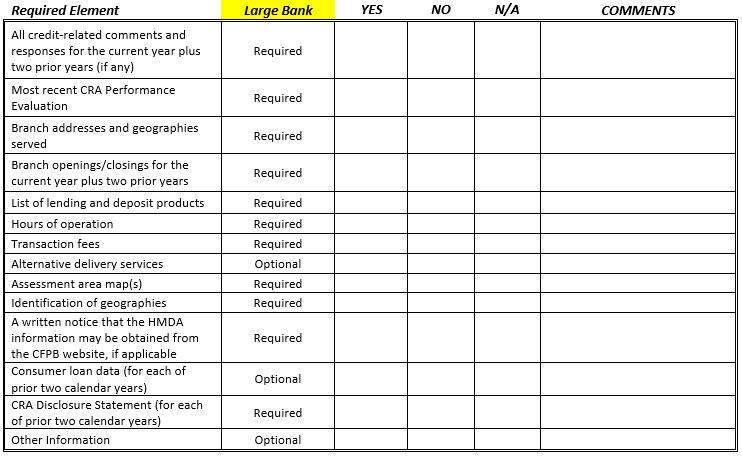

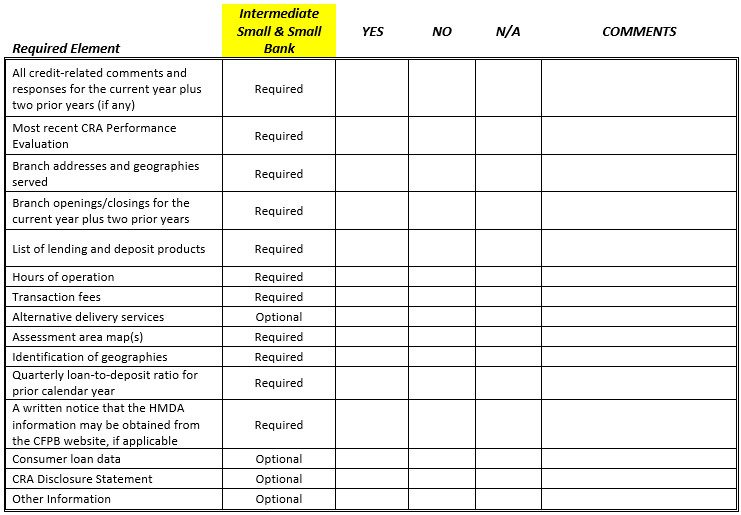

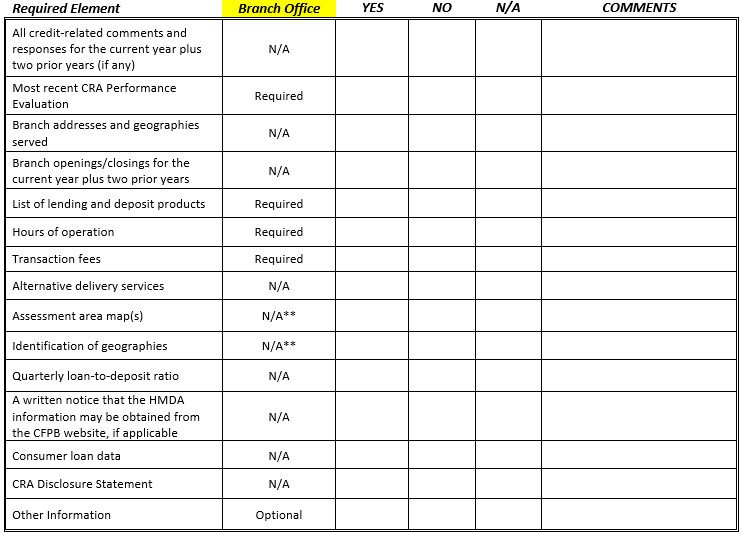

It will not be a laughing matter when your regulator comes in and reviews your CRA Public File and it hasn’t been updated annually as of April 1st. By now, everyone has probably obtained or produced a checklist to ensure all items are in the file; if not, at the end of this article we have provided for your use checklists for both large and small institutions and requirements for a Branch file.

The first point is that every compliance person’s calendar should “tickler” at least one week (if not more) prior to April 1st – a reminder to start gathering information for the CRA Public File. However, some of the information should be gathered throughout the year, such as credit-related comments. Keep a file folder (electronically or on paper) of new products, fee changes, notes/cards/emails from customers expressing thanks for any community involvement, any new census tracts – and, of course, complaints. It is much harder to find or recreate the necessary information just before it needs to be placed in the updated public file.

Some things that TCA has noted as exceptions in CRA Public File reviews are:

- Transaction fees for lending and deposits are not in the file or not updated April 1st;

- Hours of operation do not match what is on the bank’s website;

- Assessment area maps are outdated;

- Services do not match what is on the bank’s website;

- Census tract changes are not updated in the file; and

- New assessment areas have not replaced old documentation.

In addition, it is important to review information for accuracy and consistency across Disclosures, Website, Advertisements, Lobby posters; all the information should match.

Sometimes, the bank is not aware of census tract changes being made. Due to technology changes, it is easy to obtain current census tracts for the bank’s assessment area. Below we provide step-by-step instructions on how to obtain your current census tracts.

Using https://www.ffiec.gov

Click on “FFIEC Census and Demographic Data”:

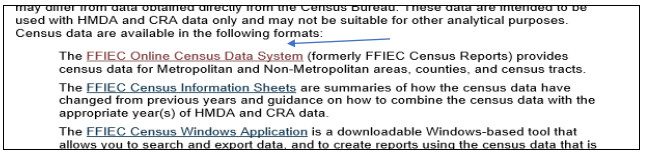

Click on “FFIEC Online Census Data System”:

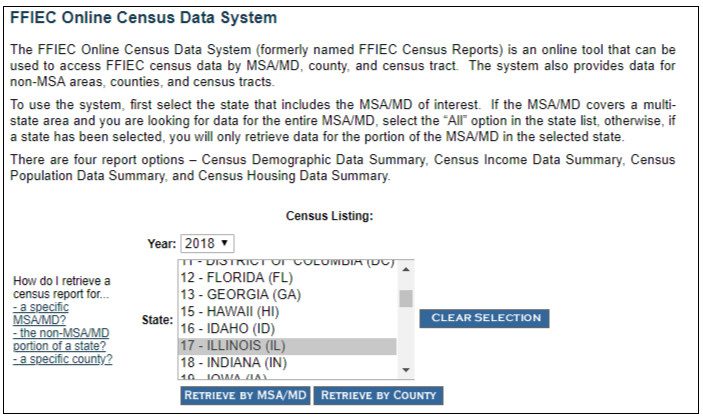

Click on year and state and then retrieve by county:

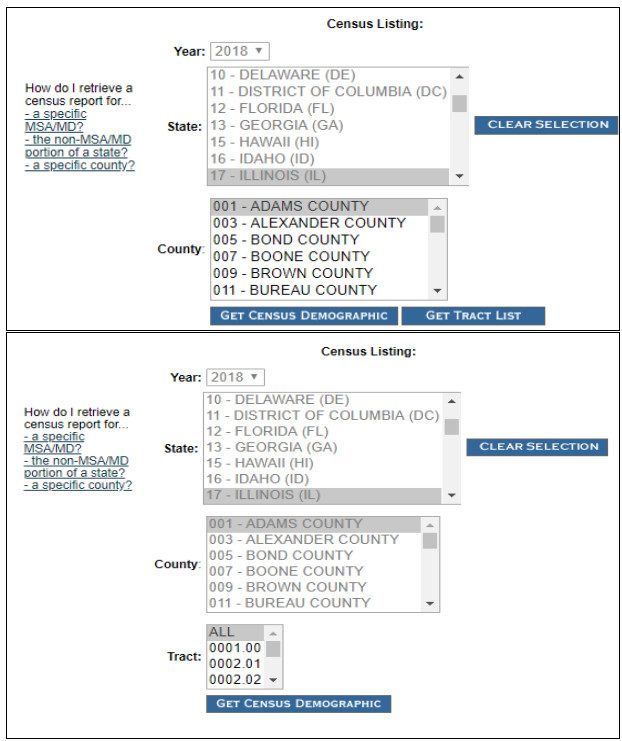

Click on county/city and then click on “Get Tract List”:

Click on “Get Census Demographic.”

A CRA public file can be made available in print or electronically, such as through email or placed on your bank’s website. However, if a print copy is requested it must be provided in print.

Effective last January 1, 2018, the public file must include written notice that the bank’s HMDA Disclosure Statement may be obtained by going to the Consumer Financial Protection Bureau’s website at www.consumerfinance.gov/hmda. In addition, a bank electing to have the CFPB consider the mortgage lending of an affiliate shall include the name of the affiliate and a notice that the affiliate’s HMDA Disclosure Statement may be obtained at the Bureau’s website. The bank shall place the notice(s) in the public file within three business days after receiving notification from FFIEC of the availability of the disclosure statement(s).

Below are the checklists for Large CRA institutions, Intermediate-small and small banks (which are the same), and the Branch file checklist.

** Must be available upon request by the customer within 5 calendar days

Although this seems like a minor task, the required public file information is important and can cause “examiner annoyance” in the CRA exam that can be easily avoided by timely updating. Review your CRA Public File to ensure it is current and no tricks or pranks are afoot before April 1st!