TCA’s February 7, 2019 Special Release “Final Rules Released for Acceptance of Private Flood Insurance” said lenders can accept a private flood insurance policy and easily identify an acceptable policy. The rule suggests private providers add the following “compliance aid” clause:

‘‘This policy meets the definition of private flood insurance contained in 42 U.S.C. 4012a(b)(7) and the corresponding regulation.’’

When the private policy contains this statement, lenders know the policy meets the definition of private flood insurance without conducting any further review of the policy. Until now, many private flood insurance policies used a similar disclosure, “The policy meets the provisions required by the Biggert-Waters Act.” Now that the final private insurance rules have been released, we should no longer see this de facto pre-rule disclosure.

While it is suggested that private insurance policies contain this recommended compliance aid statement, it is a safe bet that lenders will see policies without this exact language. Another potential hurdle is getting the actual policy prior to closing.

Now that there are final rules, lenders can expect much more scrutiny of private flood insurance due diligence.

Consequently, lenders will need to add to their flood policy/procedure how they will handle receipt of private flood insurance documentation. Looking at the process, first let’s address the situation where the lender receives a flood application or declaration page but not the policy. The new rule indicates that acceptance of a private flood insurance policy will require an analysis of the policy. So, a private flood policy is necessary before a lender can formally accept the insurance.

This could be an issue because getting a policy prior to closing on purchase transactions if the property is in a flood zone can be lengthy. Will the borrower be told to delay closing or initially have to purchase an NFIP policy? Lenders should formally define in their policy how private policies will be handled in both purchase and refinance transactions.

This should be less of a problem for refinance transactions. If the lender has previously reviewed a similar policy issued by the same company, it might assume that the analysis of the previous policy content meets the private insurance rules. The risk trade-off of closing the loan or waiting needs to be weighed. In the absence of greater guidance and the potential fines, it seems too risky to act prematurely– but that is a lender decision.

Once a private policy is provided, lenders are faced with two more choices. First, the path of least resistance is to find the “compliance aid” statement which signals that the private flood insurance policy follows the new rule. Otherwise, a lender needs to review the policy and on a discretionary basis accept or reject the policy.

Regardless of whether the choice is the compliance aid statement or discretionary acceptance, the decision should be documented. When following the discretionary acceptance path, there are four factors to consider:

- Is there sufficient coverage?

- Is the policy issued by and entity authorized to do so?

- Does the policy cover both the mortgagor and mortgagee as loss payees?

- Does the policy provide sufficient loan protection consistent with general safety and soundness principles?

The first three factors are fairly easy to determine. The last factor requires a little deeper dive. What is meant by “provide sufficient protection”? This phrase is not specifically defined in the new rule. However, in the preamble to the rule, it says determine:

- Whether the flood insurance policy’s deductibles are reasonable based on the borrower’s financial condition;

- Whether the insurer provides adequate notice of cancellation to the mortgagor and mortgagee to ensure timely force placement of flood insurance, if necessary;

- Whether the terms and conditions of the flood insurance policy with respect to payment per occurrence or per loss and aggregate limits are adequate to protect the regulated lending institution’s interest in the collateral;

- Whether the flood insurance policy complies with applicable State insurance laws; and

- Whether the private insurance company has the financial solvency, strength and ability to satisfy claims.

These are the only factors mentioned. The preamble doesn’t state these four factors must be considered; but in the absence of regulatory expectations, TCA would suggest that any analysis document these or other considerations.

Now, one might ask, if a lender follows the discretionary acceptance path and it is documenting its due diligence, why would it even spend the time to confirm a policy meets the definition of “private flood insurance”?

Well, one reason jumps out: You cannot reject a policy without confirming it does not meet the definition of “private flood insurance.” Of course, if you are rejecting it under discretionary acceptance, you probably have discovered a flaw that will make the policy not eligible under the “private flood insurance” rule. The second reason why you might have to perform the mandatory acceptance analysis (assuming it does not have the compliance aid statement), is that your secondary market investors may not accept a private flood policy that does not meet the definition of such.

Currently, Fannie Mae guidance found in the Selling Guide under B7-3-07: Flood Insurance Coverage Requirement indicates the following:

Acceptable Flood Insurance Policies

The flood insurance policy must be either:

- a standard policy issued under the NFIP; or

- a policy issued by a private insurer as long as

- the terms and amount of coverage are at least equal to that provided under an NFIP policy based on a review of the full policy issued by a private insurer, and

- the insurer meets Fannie Mae’s rating requirements as specified in B7-3-01, Property Insurance Requirements for Insurers.

It is interesting to note that Fannie Mae indicates the analysis of the coverage cannot be performed by simply reviewing declaration pages; rather, a seller must perform a review of the policy itself. Given this guidance, a lender may wish to confirm the policy meets the definition of “private flood insurance” rather than risk having to buy back a loan for a document deficiency. Additionally, a bank should consult with its other private investors to determine their expectations regarding private flood insurance.

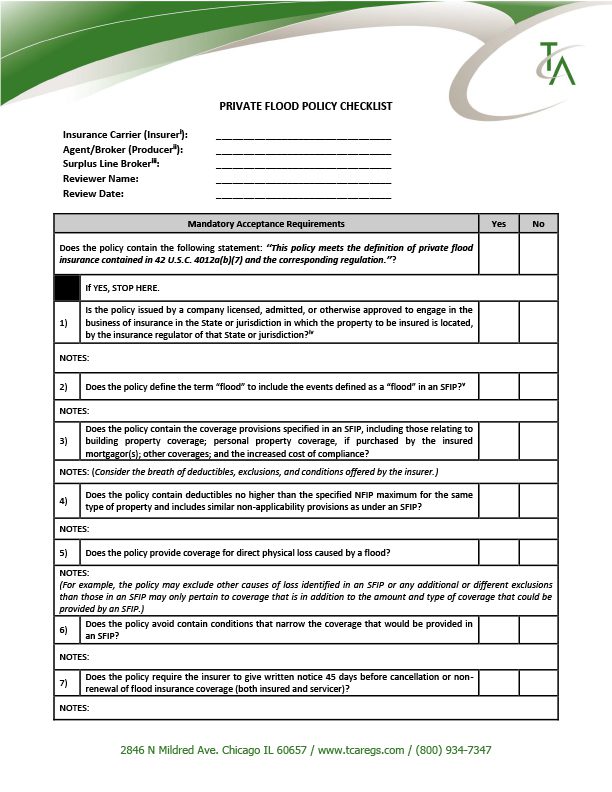

The bottom line is that banks need to update their flood policy and procedures to address how they will facilitate private flood insurance. To assist you, TCA has developed a sample private flood insurance checklist. This is only a sample and not legally vetted. If your institution chooses to consider this tool, it should be modified appropriately based on each bank’s policy and procedures.

Private Flood Policy Checklist (PDF)