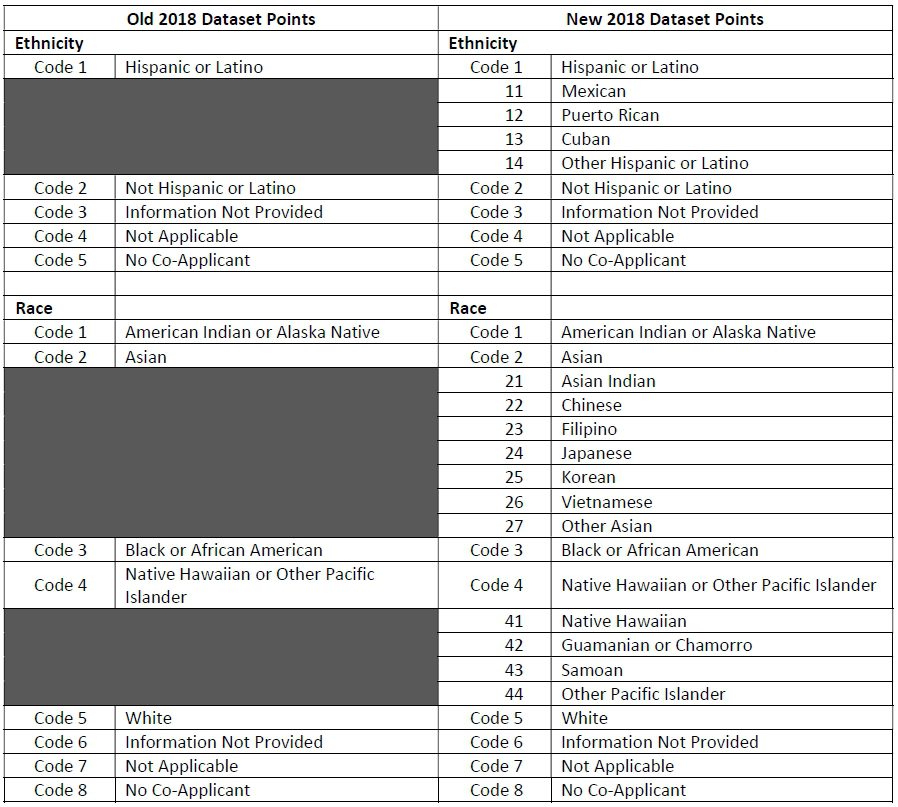

The Consumer Financial Protection Bureau (CFPB) mandated changes to the collection of HMDA dataset information which was implemented in 2018. Significant changes were made in the areas of Ethnicity and Race which impacts the fair lending analysis process. In 2018 and going forward, Ethnicity and Race require additional information be available on the dataset form that enables the applicant to document their ethnicity and race in greater detail. The table below provides the additional required information and a comparison with prior collection requirements.

| Old 2018 Dataset Points | New 2018 Dataset Points | ||

|---|---|---|---|

| Ethnicity | Ethnicity | ||

| Code 1 | Hispanic or Latino | Code 1 | Hispanic or Latino |

| 11 | Mexican | ||

| 12 | Puerto Rican | ||

| 13 | Cuban | ||

| 14 | Other Hispanic or Latino | ||

| Code 2 | Not Hispanic or Latino | Code 2 | Not Hispanic or Latino |

| Code 3 | Information Not Provided | Code 3 | Information Not Provided |

| Code 4 | Not Applicable | Code 4 | Not Applicable |

| Code 5 | No Co-Applicant | Code 5 | No Co-Applicant |

| Race | Race | ||

| Code 1 | American Indian or Alaska Native | Code 1 | American Indian or Alaska Native |

| Code 2 | Asian | Code 2 | Asian |

| 21 | Asian Indian | ||

| 22 | Chinese | ||

| 23 | Filipino | ||

| 24 | Japanese | ||

| 25 | Korean | ||

| 26 | Vietnamese | ||

| 27 | Other Asian | ||

| Code 3 | Black or African American | Code 3 | Black or African American |

| Code 4 | Native Hawaiian or Other Pacific Islander | Code 4 | Native Hawaiian or Other Pacific Islander |

| 41 | Native Hawaiian | ||

| 42 | Guamanian or Chamorro | ||

| 43 | Samoan | ||

| 44 | Other Pacific Islander | ||

| Code 5 | White | Code 5 | White |

| Code 6 | Information Not Provided | Code 6 | Information Not Provided |

| Code 7 | Not Applicable | Code 7 | Not Applicable |

| Code 8 | No Co-Applicant | Code 8 | No Co-Applicant |

In addition, both the ethnicity and race sections have open free text fields that can be added if the descriptions provided do not apply and the applicant desires to provide more detail on their ethnicity or race.

The Federal Financial Institutions Examination Council (FFIEC) had established the original grouping methodology for ethnicity and race and defines how the ethnicity and race data are aggregated once the HMDA data has been submitted each year to the CFPB. The CFPB continues to utilize these grouping methodologies even after the expansion of the ethnicity and race fields. The FFIEC grouping definitions of ethnicity, race and minority status (which is also impacted by the recent changes) are as follows:

Borrower Ethnicity Grouping

Applicants are shown in only one ethnicity category. For purposes of categorization, the general rule is: The ethnicity (including situations where ethnicity was reported as Not Provided or Not Applicable (codes 6 and 7)) of the application is categorized by the ethnicity of the first person listed on the application unless the “Joint” ethnicity definition applies. (“Joint” means one applicant reports ethnicity as Hispanic or Latino and the other applicant reports ethnicity as Not Hispanic or Latino).

Borrower Race Grouping

Applicants are shown in only one race category. For purposes of categorization, the general rule is: The race (including situations where race was reported as Not Provided or Not Applicable (code 6 and 7)) of the application is categorized by the race of the first person listed on the application unless the “Joint” race definition applies. (“Joint” means one applicant reports a single racial designation of “White” and the other applicant reports one or more minority racial designations). If the “Joint” definition does not apply, the race of the first person on the application is categorized as follows:

- The reported race when a single racial designation is reported; or

- “2 or More Minority Races” when two or more minority racial designations are reported; or

- The minority race when two racial designations are reported, and one is White.

Minority Status Grouping

“Minority Status” combines Information reported on race and ethnicity. “White Non-Hispanic” consists of applicants of White race who are not of Hispanic or Latino origin. The “Other Hispanic or Latino” in the subcategory consists of applicants of minority races or Hispanic or Latino origin. Applicant races not shown are Non-Hispanics where race is Not Available; Whites where ethnicity is Not Available and those where both race and ethnicity are Not Available.

Why does this matter and how does this affect our bank?

Now that the first year of the new datasets have been submitted and the aggregate data is available, it appears that the subcategories for ethnicity and race are not being noted separately on the HMDA disclosure tables available to the public. The defined methodology to combine the information of Race 1 and Race 2 eliminates the reporting of the expanded fields by lumping all applications reporting multiple races (including the sub-categories) into one category, “2 or More Races.” This may have a large impact on those financial institutions operating in areas where there is a large population of Asian and Native Hawaiian or other Pacific Islander individuals.

For example, the primary applicant designates their race as “2-Asian” which is noted in the Race 1 field and subcategory “24 – Japanese” noted in the Race 2 field. The Aggregate data and the Public disclosure tables for this Bank will show this applicant in the “2 or More Races” category and not noted as “Asian.” This aggregation method eliminates the ability to analyze an institutions performance at the race or race subcategory level. The more individuals utilize the sub-categories, which were designed to better reflect the demographics of the population, the less specific the aggregation will be and will not provide a clear picture of a bank’s performance in lending to minority racial groups. Each of those applications reported at the subcategory level will inflate the “2 or More Races” which now will contain other races.

In another example, the Bank’s LAR had a total of 500 applications and the total of primary applicants designated as “2-Asian” in Race 1 was 100. Fifty of the Asian applicants marked themselves with a subcategory in Race 2 resulting in those 50 applications being aggregated in the” 2 or More Race” category. The results will now show that the bank only had 50 “Asian” applications. Which may indicate poor performance to this segment of the population.

When conducting a fair lending analysis, banks need to be aware of the way the aggregation method may skew the categories for each race if other subcategory sections have been marked and thus demonstrate a poorer performance in those race categories impacted. Banks will need to make sure it understands the data it collects, especially if it has a large percentage of applications in the “2 or More Races” category and the impact this could have on any comparative fair lending analysis performed.

It is interesting to note that the subcategories created in the ethnicity section have no impact. Either the applicant is Hispanic or Not Hispanic in addition to the codes for information not provided or if not applicable.

The definitions noted above can also assist the bank in understanding how the ethnicity and race are grouped. The Aggregate data has a category in race as “White-Hispanic or Latino” (even though there is no such race category) which at times does not match the number recorded for the Ethnicity Hispanic count. This occurs when one applicant reports a race of White and not Hispanic ethnicity and a co-applicant states White race and Hispanic Ethnicity; the application will be categorized off the co-applicant and will be noted as White-Hispanic or Latino. Whereas only the primary applicant that designated ethnicity as Hispanic will be counted in the Ethnicity section. So, for example, the Bank had 10 applications with a primary applicant designation of Hispanic Ethnicity and 50 primary applicants with Non-Hispanic Ethnicity. Of the 50 Non-Hispanics, there were 15 that were joint with a co-applicant that had the designation for Ethnicity as Hispanic and Race as White. The Aggregate data and disclosure tables will show a Race category for White-Hispanic or Latino total as 25 applications.

As banks perform their internal analysis and focuses on their performance in the individual race categories, they need to keep in mind those applicants that may have provided a subcategory designation because the analysis may either overstate or understate their performance in each category or when compared to the peer aggregate.

Therefore, it is imperative that banks understand their numbers when performing fair lending analyses, especially when comparing lending results to peer aggregate data to avoid inaccuracies. Banks can perform an analysis based off Race 1 of the primary applicant for ‘Asian” and “Native Hawaiian or Other Pacific Islander” without the subcategories but need to realize that is not how the regulatory agencies will review the HMDA data.

This In-Depth is complicated to grasp and that is why it is even more important to ensure you know the intricacies of the fair lending data output. Please contact TCA to discuss What’s in Your Fair Lending Data so you can tell regulators the facts to avoid fair lending problems. TCA can provide knowledgeable assistance in a fair lending analysis.