Educating and Mentoring Your Team

Bringing customized education and coaching to keep your team informed on the latest compliance regulations.

We train, coach, and mentor your staff and executives to help them understand their responsibilities and build the skills necessary to foster an institution-wide culture of compliance.

Creating and sustaining a culture of compliance starts with ensuring that all employees, from board members to the bank’s frontline staff, thoroughly understand compliance rules and regulations and know their obligations.

TCA has been conducting formal and informal training since the inception of the company 30 years ago.

During every engagement, we take the opportunity to coach your compliance professionals and impart the knowledge we have.

We also provide formal education in all aspects of compliance and develop training, presentation materials, and targeted classes that conform to your needs and address your bank’s unique vulnerabilities.

Sometimes, it’s as simple as training the frontline staff on the compliance requirements associated with opening a savings account. Some ask us to mentor new compliance officers and broaden their skills.

Others seek reinforcement training for board members concerning their oversight role. That may entail detailing the emerging regulatory landscape and illustrating how nurturing a culture of compliance intersects with keeping the bank competitive serves as a trusted asset in its community.

No matter your education needs, TCA provides A Better Way to develop your bank’s intellectual capital.

Key deliverables include:

- Providing live or remote training sessions tailored to your bank’s needs.

- Conveying clear and relatable communication of regulatory requirements.

- Developing sensible recommendations and feasible implementation strategies.

Training Insights

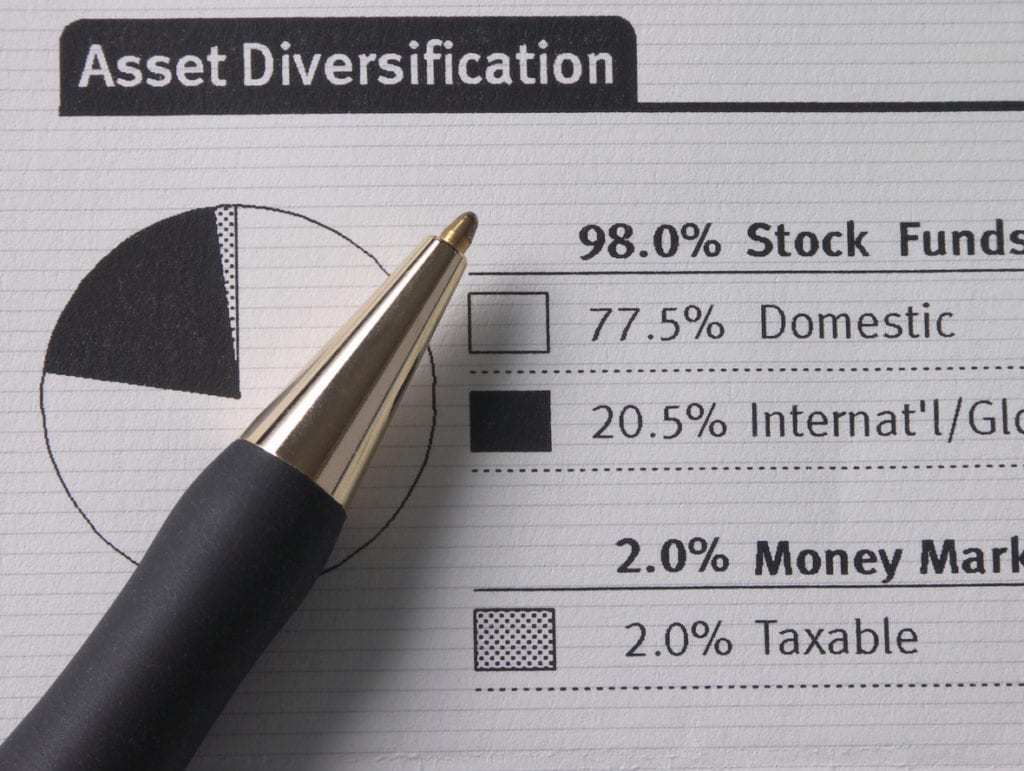

CRA Asset-size Thresholds Announced for 2019

The annual CRA asset-size thresholds for covered financial institutions were announced on December 20, 2018 applicable for 2019. The cutoff adjustments are based on the change in the CPI (Consumer Price Index) for each 12-month period ending in November, rounded to the nearest million. As a result of the 2.59% increase in the CPI, the […]

Submit Comments to CRA Modernization Initiative

Several staff members of Thomas Compliance Associates (TCA) attended the recent CRA & Fair Lending Colloquium and obtained valuable information from the sessions. One theme that stood out and presenters stressed was that bankers can help shape the re-write of the Community Reinvestment Act (CRA) regulation. The Office of the Comptroller of the Currency (OCC) […]

Quality Assurance Monitoring for BSA/AML Compliance Programs

When your institution is examined for compliance with any law or regulation, the measure of your efforts will be based on your ability to self-identify and self-correct any deficiencies. Ongoing monitoring of key processes helps to ensure that any errors or warning flags are identified early. Monitoring is a required element of a compliance management […]

Amid Data Reporting Uncertainty, HMDA Risk Must Be Managed: Part 1—How is it Going?

Now that more than half the year is gone, many banks are starting to look more closely at their new 2018 HMDA LAR requirements because they have adequate volume to do testing. TCA wants to share with you what we have found in doing preliminary HMDA LAR validations. Many of the issues we’ve seen are […]

Model Validations—Why Do I Need a GAP Analysis?

The regulators are upping their game and are becoming more familiar with Automated Monitoring Systems. They are starting to push the boundaries of a model validation and their expectations for a “complete” model testing review. Some examiners are more advanced than others, but the word is being spread and soon they’ll all catch on! This […]

The Expectation of Exceptions in the World of Fair Lending

Exception reporting is not new; all banks are required to report loan policy and loan documentation exceptions for Safety and Soundness. However, a new unwritten rule is fair lending exception tracking covering pricing and underwriting exceptions on consumer loan products. Whether it’s HMDA for banks with less than or more than 500 entries, regulators want […]