Specialties

Model Governance

Data Integrity

Model Output and Performance

Helping you meet regulators’ demands for independent AMS model reviews

We bring the people and know-how to conduct rigorous, risk-based AMS model validations to assess how well your model governance, data integrity, and parameter thresholds adhere to regulatory guidance.

Conducting an AMS model validation is both an art and a science.

Hundreds of banks and credit unions view us as trusted artists and scientists and count on us to bring insightful regulatory intelligence during AMS model validations.

With real-world experience as former bankers, we understand the effect of increased regulatory pressure on your team. Relying on plug-and-play settings, for example, is a path to frustration, and we know how it feels to be overwhelmed by alerts and struggle to discern what warnings to heed or ignore.

Members of our team have done everything from examining data integrity and its quality and conducting “above the line” and “below the line” testing to assessing a model’s design and how well it’s tailored to your risk profile.

We also bring a solid track record in understanding the quirks of various AMS solutions in the marketplace and performing system validations on them.

Our assessments consider both IT and BSA perspectives, and we focus on three areas:

- Model governance

- Data integrity

- Model output and performance

Throughout each engagement, we communicate with you to keep you informed on our progress and findings. At the conclusion, our exit meeting and written report document our scope, methodology, findings, and recommendations.

Once our AMS Validation is complete, you can be confident that your model is sound and meet examiners’ escalating expectations.

TCA gives you A Better Way to gauge whether your AMS model meets its objectives and protects you from money-laundering risks.

Key Deliverables Include:

- Testing administrative controls, data import, and data integrity.

- Reviewing system parameters to be sure they’re functioning correctly and identifying suspicious activity.

- Ensuring that your model has been calibrated to your bank's risk profile.

- Analyzing exams, reviews, and monitoring reports to trace the resolution of issues requiring corrective action.

- Providing exceptional service that respects your time.

AMS Insights

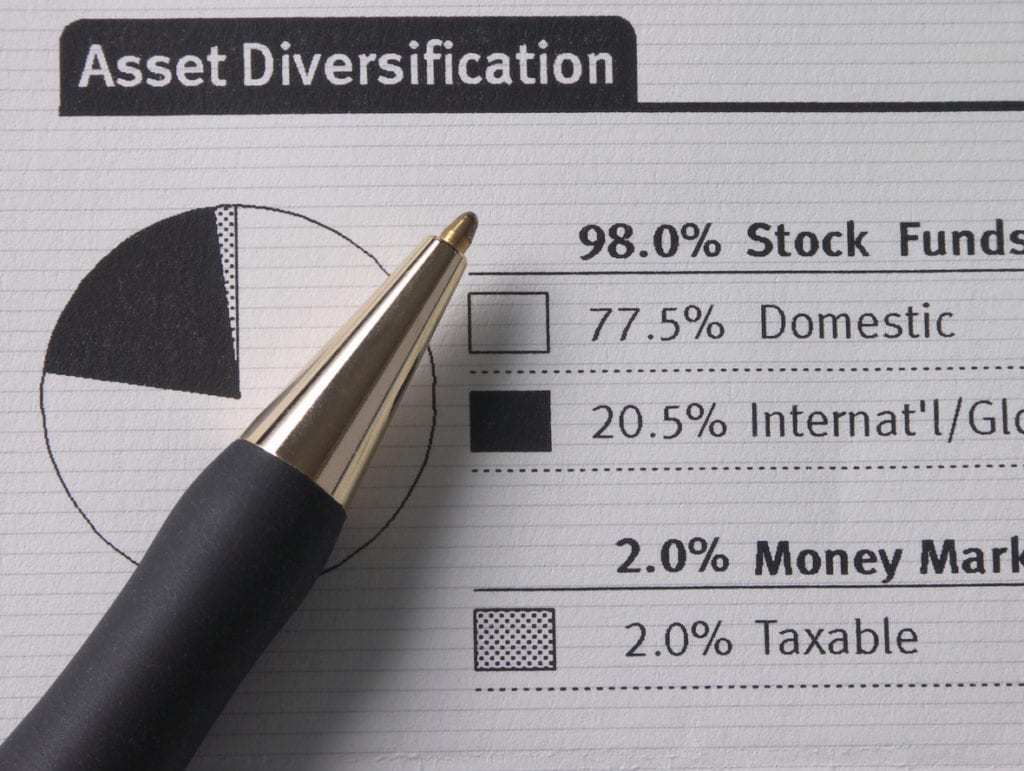

CRA Asset-size Thresholds Announced for 2019

The annual CRA asset-size thresholds for covered financial institutions were announced on December 20, 2018 applicable for 2019. The cutoff adjustments are based on the change in the CPI (Consumer Price Index) for each 12-month period ending in November, rounded to the nearest million. As a result of the 2.59% increase in the CPI, the […]

Will National Flood Insurance Program Expire?

On November 20, 2018, FEMA posted a press release reminding interested parties that the National Flood Insurance program (NFIP) expires at 11:59 p.m. on November 30, 2018. While FEMA is confident Washington will vote to reauthorize the NFIP, if a lapse were to occur, it would not impact policies already in effect. We will continue […]

Regulation Z and Regulation M Dollar Thresholds for 2019

The Federal Reserve Board and the Consumer Financial Protection Bureau jointly issued an increase in the exemption thresholds, which are tied to the Consumer Price Index, for Regulation Z and Regulation M exemptions. Loans or leases at or below the thresholds are subject to regulatory protections. The regulators have released the new index limit for […]

Submit Comments to CRA Modernization Initiative

Several staff members of Thomas Compliance Associates (TCA) attended the recent CRA & Fair Lending Colloquium and obtained valuable information from the sessions. One theme that stood out and presenters stressed was that bankers can help shape the re-write of the Community Reinvestment Act (CRA) regulation. The Office of the Comptroller of the Currency (OCC) […]

FFIEC Releases 2017 CRA Public Data Tables

On October 25, 2018, the FFIEC released the public disclosures for CRA data submitted for the calendar year 2017. Institutions that report CRA data should go to the FFIEC website and download their disclosure tables for availability on request. The report should be made a part of your CRA Public File within three business days […]

Regulatory Announcements October 2018

Various regulatory agencies have released resources over the past couple weeks. As part of being a compliance partner and showing clients A Better Way with TCA, please see the following key insights. Appraisal FAQ Released On October 16, 2018, the OCC, FDIC and FRB released a joint Frequently Asked Questions document in response to comments […]