The mortgage application, the 1003 or URLA – these are all synonyms for the standard residential mortgage application which has been changed. Navigating through these changes can be stressful; but we are here to help.

Fannie/Freddie announced the release of the redesigned Uniform Residential Loan Application (URLA) on August 23, 2016. The changes would include a reorganized format, new and updated fields, clearer instructions, revised Government Monitoring Information, and a Spanish-language version would be available soon. Lenders were to begin using the new form on January 1, 2018.

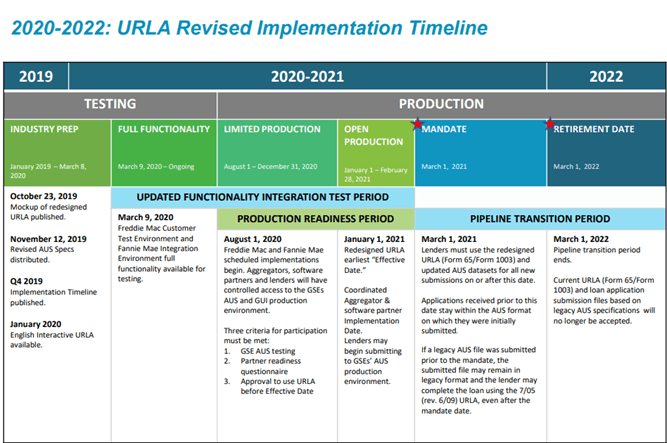

There were several setbacks, so the rollout was delayed, but the new deadline to begin using the redesigned form is March 1, 2021. For those of you who are HMDA reporters, this date will hold special meaning to you!

By now you have probably received several announcements from your loan origination system provider on what should be done to ensure the new 1003 is up and running, and some of you may have been ready to begin submitting loans during the open production period effective January 1, 2021. The time is now for using the revised form, and we wanted to highlight the changes and provide you with some best practices and suggestions as you begin using this form.

Challenges

Well, it’s new and change always presents challenges. If you are going to sell your loans to Freddie Mac or Fannie Mae or other Secondary Market Investors, the new 1003 is required; therefore, you need to make sure your system is ready, and training will be required for Loan Officers, Processors and Underwriters. The AUS systems (DU and LP) will be updated to accommodate the added fields. If your Loan Officers complete the initial application using a paper copy, make sure all old copies of printed applications are not stuck in a drawer or allowed to be used after March 1, 2021.

If you don’t sell to Fannie or Freddie or to other investors, you are not required to use the new form; however, if you use a loan origination system (LOS) to prepare your documents will they provide the “old form” as an option? If not, will you be using a custom form or will you use the new 1003? Your procedures will need to be adjusted to set the expectation for completion.

So, what has changed?

In keeping with the more-is-more methodology, the length of the application is now nine pages. The following pages highlight what has changed and a link to the new 1003 has been provided.

Page 1 – New Application

Section 1a: Personal Information Borrower Information

- A space to enter an Alternate Name(s) for the Borrower was added.

- The Type of Credit – Individual or Joint was added along with a open field box to add names of others applying.

- A Cell Phone and Work Phone field was added.

- The Years of School was removed.

- The Current Address section has a radio button to indicate “No primary housing expense” and if current address is less than two years, has a radio button to indicate “Does not apply.”

Section 1b. Current Employment/Self-Employment and Income

- A radio button was identified as “Does not apply” was added.

- A Start date was added.

- Self-employed information was expanded to include the following questions:

- I have an ownership share of less than 25%.

- I have an ownership share of 25% or more.

- Monthly Income (Or loss) $

- Gross Monthly Income section was added to each employer listed.

Page 2 – Section 1

Section 1c. IF APPLICABLE, Complete Information for Additional Employment/Self-Employment and Income

- A radio button identified as “Does not apply” was added.

- A Start date was added.

- Self-employed information was expanded to include the following questions:.

- I have an ownership share of less than 25%.

- I have an ownership share of 25% or more.

- Monthly Income (Or loss) $

- Gross Monthly Income section was added to each employer listed.

1d. IF APPLICABLE, Complete Information for Previous Employment/Self-Employment and Income

- A radio button identified as “Does not apply” was added.

- A Start and End Date was added.

- A radio button indicating the borrower was the Business Owner or Self-Employed was added.

- Previously Gross Monthly Income field was added.

1e. Income from Other Sources

- A radio button was added “Does not apply”.

- The Income Source list has been expanded.

Page 3 – Section 2: Financial Information – Assets and Liabilities. (NEW)

- The paragraph explaining what the section is for changed.

2a. Assets – Bank Accounts, Retirement, and Other Accounts You Have

- Assets identification type has been added.

2b. Other Assets and Credits You Have section has been added.

- A radio button was added “Does not apply”.

- This section allows the borrower to provide details from assets being sold, Gift funds, Earnest Money, etc.

2c. Liabilities – Credit Cards, Other Debts, and Leases that You Own.

- A radio button “Does not apply” added.

- A list of liability types has been added.

- A check box for “To be paid off at or before closing”.

2d. Other Liabilities and Expenses

- A radio button “Does not apply added.

- A list of other liability types has been added.

Page 4 – Section 3 – Financial Information – Real Estate (NEW)

3a. Property You Own

- A radio button for “I do not own any real estate” has been added.

- A request to add the property that you are refinancing (if applicable) first.

- Intended Occupancy (instead of Type of Property).

- A field “For Lender” to show Net Monthly Rental Income.

Mortgage Loans on this Property

- A radio button for “Does not apply” has been added.

- Type of mortgage on property has been added.

- Credit limit (if applicable) has been added.

- A radio button “To be paid off at or before closing” has been added.

3.b IF APPLICABLE, Complete Information for Additional Property

- Same as 3.a

3.c IF APPLICABLE, Complete Information for Additional Property

- Same as 3.a

Page 5 – Section 4: Loan and Property Information (NEW)

4.a Loan and Property Information

- FHA Secondary Residence radio button added.

- Mixed-Use Property questions added.

- Manufactured Home question added.

- Items no longer on application regarding loan: Amortization type (Fixed, ARM), Interest Rate, Term (30, 15, 10).

4b. Other New Mortgage Loans on the Property You are Buying or Refinancing

- New section to capture other liens on subject property.

4c. Rental Income on the Property You Want to Purchase

- New section to capture Expected Monthly Rental Income.

4d. Gifts or Grants You Have Been Given or Will Receive for this Loan

- New section (replaces field from Details of Transaction).

Page 6 – Section 5: Declarations (NEW)

5a. About this Property and Your Money for this Loan

- This is a new section and more detailed questions.

5b. About Your Finances

- This is a new section and some of the questions are from the old 1003 Declaration page.

Page 7 – Section 6: Acknowledgments and Agreements (NEW)

Acknowledgments and Agreements

- The information is similar however numbers deleted are:

- (3) The property will not be used for any illegal or prohibited purpose or use.

- (4) All statements made in this application are made for the purpose of obtaining a residential mortgage loan.

- (5) The property will be occupied as indicated in this application.

- (9) Ownership of the Loan and/or administration of the loan account may be transferred with such notice as required by law.

Page 8 – Section 7: Military Service (NEW)

- This is a new set of questions asked regarding the applicant’s military service.

- Answers apply to both the applicant and applicant’s deceased spouse.

Section 8: Demographic Information (NEW)

- Incorporates the Demographic Information Addendum created to accommodate the expanded Race, Sex and Ethnicity categories.

- Explanation as to why Lender is asking for information and sub-categories are broken out in detail.

Section 9: Loan Originator Information (NEW)

- The Loan Officer’s email has been added.

Final Comments

Some of the most common questions asked have been, “Does the entire application need to be completed?” “Is there a compliance violation if the form is incomplete?” “If I don’t use the new URLA because I don’t intend to sell the loan but then decide in the future to sell it, can I?”

Let’s go through each of those questions, starting with the completion questions. There is no regulatory requirement to complete each section, line and checkbox on an application. Under Regulation B §1002.4(c), written applications are required when the request for credit involves a 1-4 family dwelling that is or will be the applicant(s) primary residence. Applications should be completed to include information that the Bank “normally considers in making a credit decision.”

The last question – will this loan be salable if we have used the old 1003? Possibly. If, in the future, you wish to sell a group or pool of loans to an Investor, such as Fannie, Freddie or other private Investor, be sure you review their selling guidelines and requirements. It’s likely you will be able to if all other criteria for eligibility apply.

Below is the timeline for usage. Additional information and resources can be found at the following links:

Fannie Mae: Uniform Residential Loan Application (Form 1003) | Fannie Mae

Freddie Mac: Uniform Residential Loan Application (URLA) and Uniform Loan Application Dataset (ULAD) – Freddie Mac Single-Family

Timeline