The 2020 Census data has been released by the US Census – and it may impact your Assessment Area for CRA and your Lending Area for Fair Lending.

The Federal Financial Institutions Examination Council (FFIEC) which provides uniformity and consistency in the supervision of financial institutions, incorporates the US Census data in a format that is used for performance context evaluation for CRA, identifies underserved banking areas, and identifies Census Tracts within a county or city that may experience redlining discrimination practices.

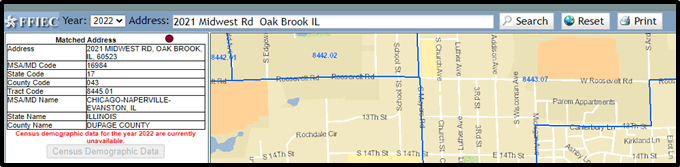

The FFIEC website has been updated for the 2022 Census Tract Geocoding only. The 2022 demographic information has not been updated as noted in the disclaimer in red below.

The data displayed on the FFIEC website related to demographic, income, population, and housing information remains based on 2021 information.

While we wait for the 2022 demographic information to be updated on the FFIEC’s website, Banks will need to be vigilant in ensuring the correct usage of information when conducting lending pattern reviews and utilizing demographic information to describe an assessment area or lending area.

TCA has noticed an increase in the total number of Census Tracts for 2022 in various counties, as well as a change in demographics for some tracts resulting in a change in designation (i.e., Low Income Tract in 2021 vs. Moderate Income Tract in 2022). In addition, the changes to 2022 data may result in changes to your Assessment Area regarding the Census Tract classification based on the minority population level of the Census Tracts. Low/Moderate Census Tracts and substantially minority Census Tracts are the areas of risks for the Bank. The changes may require Banks to adjust their lending efforts and update its focus to these areas of risk.

The charts below demonstrate the changes for the City of Richmond, VA and Cook County, IL. by Income Census Tract Level and Minority Census Tract levels. The areas of risk which are the focus of regulatory agencies and special interest groups are bolded in each matrix.

City of Richmond, VA

| Income Census Tract Level | 2021 | 2022 |

| Low | 22 | 15 |

| Moderate | 17 | 26 |

| Middle | 10 | 13 |

| Upper | 16 | 19 |

| Not Known | 1 | 2 |

| Total | 66 | 75 |

| Minority Census Tract Level | 2021 | 2022 |

| 0 to less than 10% | 4 | 1 |

| 10% to less than 19% | 8 | 11 |

| 20% to less than 50% | 16 | 20 |

| 50% to less than 80% | 13 | 21 |

| 80% and more | 25 | 22 |

| Not Known | 0 | 0 |

| Total | 66 | 75 |

The impact of the 2022 change for the City of Richmond noted nine additional Census Tracts.

Cook County, IL

| Income Census Tract Level | 2021 | 2022 |

| Low | 253 | 225 |

| Moderate | 381 | 351 |

| Middle | 317 | 369 |

| Upper | 355 | 371 |

| Not Known | 13 | 16 |

| Total | 1,319 | 1,332 |

| Minority Census Tract Level | 2021 | 2022 |

| 0 to less than 10% | 33 | 6 |

| 10% to less than 19% | 148 | 94 |

| 20% to less than 50% | 381 | 443 |

| 50% to less than 80% | 253 | 271 |

| 80% and more | 500 | 516 |

| Not Known | 4 | 2 |

| Total | 1,319 | 1,332 |

The impact of the 2022 change for the Cook County noted nineteen additional Census Tracts.

TCA recommends that each Bank review for potential changes to their Assessment and Lending Areas and adjust accordingly. The review should include the identification of the new Census Tracts or removed census tracts based on a comparison of the 2021 Census Tract listing to the 2022 Census Tract listing. The review should also identify Census Tract classification changes. This review will allow the Bank to identify additional areas of risk associated with an increase in low/moderate income Census Tracts or substantially minority Census Tracts, both of which will require new areas of focus by the Bank. On the other hand, Census Tracts that have been classified as low/moderate income Census Tracts or substantially minority Census Tracts in the past may no longer be areas of risk.

The analysis should be reported to the Compliance Committee, Senior Management and Board of Directors with comments on the changes to the Bank’s risk levels and recommendations on actions that may need to be taken to mitigate the increased risk going forward. In addition, monitoring of the lending patterns for CRA and Fair Lending will need to be adjusted for the updated geographic definitions of the Assessment Area for CRA and the Lending and Reasonably Expected Market Area (REMA) for Fair Lending.

The CRA Public File does not need to be updated until April 1st of the following year; however, it would be a best practice to demonstrate that the Bank is aware of the changes and update the Bank’s CRA Public File to reflect the 2022 changes. The updates would include the new Census Tracts for the listing of Census Tracts of the Bank’s assessment area and maps. In addition, it would be recommended to geocode the branch locations as some may now be in the new Census Tracts.

Please contact the TCA office if you have additional questions regarding this matter and would like to discuss further. In addition, if your Bank needs assistance in identifying the new Census Tracts and changes to the classification of existing Census Tracts, please contact us at 800-934-7347 to schedule time for a consultation.

TCA – A Better Way!