These days, losses from Regulation E error claims are accepted by many institutions as the cost of doing business. Many institutions are relying more heavily upon internal and/or third-party fraud detection and prevention resources. But as you know, managing risk of loss is just part of the story. Regulation E compliance and financial risk continues to increase as some of the Agencies now consider error resolution claim findings to be consumer harm. Lookbacks and customer restitution relating to consumer harm can result in up to six years’ worth of reimbursements instead the maximum two years under Regulation E. Regardless of how Regulation E risk management is structured at your institution, having the right tools to ensure you are documenting efforts for meeting mandated provisional credit and investigation timeframes is key.

A Better Way! In keeping with our core mission of adding value to our client relationships, TCA’s Regulation E subject matter experts have developed the 2019 Regulation E Claim Calendar.

The Calendar is an effective tool to:

- Aid in tracking due dates for provisional credit and final resolution to Reg E Errors.

- Adjust provisional credit due date to account for bank holidays.

- Exclude non-Reg E claims (e.g., business cards or merchant disputes) from due dates but still allows claims to be logged and monitored.

- Based on claim type, automatically identify a 45- or 90-day investigation period.

- Use visual assistance to help prioritize claims (cells turn yellow as due dates approach and turn red if past due, cells turn green as claims are completed).

The document can be stored in a central file to allow analysts access to document claim status and management to monitor claim volume.

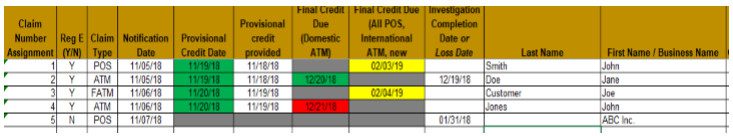

We have included a few examples demonstrating the functionality of the tool in the following table:

Claim Nos. 1 and 3 are pending resolution.

Claim No. 4 is pending resolution and past due indicating a Reg E violation.

Claim No. 5 involves a business, so Reg E timeframes do not apply.

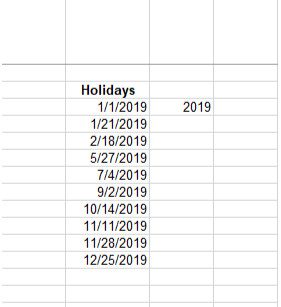

The tool also includes a worksheet for updating holidays. Holidays should be manually updated each year to ensure that provisional credit timeframes calculate correctly.

Are You Managing All of Your Institution’s Regulation E Risk? There are two sides to managing Reg E risk, and institutions that ignore compliance risk in the name of reducing fraud losses may face greater losses from civil money penalties and customer restitution. Join nationally-recognized Reg E expert, Brian Crow, on March 12, 2019 for this information-packed session which considers all facets of Reg E risk from the initial customer interview through finalizing a claim. This session will consider the following:

- Initial interview questions

- Investigation methods and tips

- When/how to involve law enforcement

- Card Cracking schemes

- Evolution of technology (Apple Pay, mobile apps, person to person payments)

- Provisional Credit

- Zero Liability

- Chip Liability Shift

- Documenting conclusions

- Investigation timeframes

- Recent Reg E enforcement actions (USAA Bank)

This is an annual “must-attend” event for deposit operations staff tasked with investigating claims, compliance officers and others accountable for maintaining policy and procedures and auditors charged with identifying control and process weaknesses.