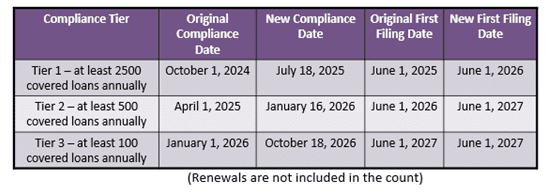

We all knew more guidance on 1071 Dodd-Frank on Small Business Data Collection was coming. On May 17, 2024, the Consumer Financial Protection Bureau (CFPB) announced an interim final rule extending the compliance dates for data collection and data reporting for financial institutions.

The Rule requires financial institutions to collect and report small business lending data each year if they originate 100 or more covered transactions in each of the two preceding calendar years.

Defining Small Businesses

It’s critical to understand what businesses are covered under 1071.

The Final Rule’s definition of “small business” incorporates, in part, the Small Business Administration’s (SBA) definition of “small business concern.” A “small business” is a small business concern that had $5 million or less in gross annual revenue for its preceding fiscal year. Thus, if a business had more than $5 million in gross annual revenue for its preceding fiscal year, it’s not a small business.

Defining Covered Originations

A covered origination is a covered credit transaction that the financial institution originated to a small business. Refinancings are also considered covered originations. However, extensions, renewals, and other amendments of existing transactions aren’t considered covered originations towards the count.

The CFPB’s website offers the Small Business Lending Collection and Reporting Requirements – Small Entity Compliance Guide on Pages 14 through 18 describe the small business loans considered covered transactions and those loans which are not.

Best Practices

Here are 8 ways to be prepared for 1071.

- Create a 1071 Implementation Committee.

- Discuss with Committee members the new requirements and how you’ll determine your loan volume.

- Document the process you use to identify the small business loans, your count methodology, and your next action steps.

- Present the plan and methodology to the Compliance Committee and include them in the minutes for record-keeping.

- Monitor Small Business originations to ensure you know which reporting tier you fall under.

- Be ready to show your thinking, methodology, and documentation to examiners.

- Meet with your stakeholders to be sure everyone understands the commercial loan workflow.

- Be sure there’s adequate space in your core system to record loan data, including revenue information and geocoding data.

Keep an eye out for additional articles and resources on 1071 implementation and preparedness.

As always, we’re here to help! TCA offers “A Better Way” to help you comply with the Small Business LAR Rule.

TCA – A Better Way!